Contents

While there are foreign https://bigbostrade.com/s listen in the U.S. as ADRs, for example, the ADR shares will remain closed at certain hours when the actual foreign shares are open, and vice-versa. The best time to trade forex is when the market is most active – this is when you’ll get the narrowest spreads and best chance of executing a trade at your desired levels. The forex market is usually most active when the market hours overlap between sessions, as this is when the number of traders buying and selling each currency increases.

This phase of the market is typically overlooked by most retail forex traders because of the slower movement of the price, which is usually a sign of less price liquidity and volatility. While all forex brokers offer stop/loss features when trading, it is possible to exceed loss levels set due to slippage. Due to the high levels of risk, this present day, traders may select a broker that offers guaranteed stop-loss orders.

Milan Cutkovic | 16 Jun 2022 An IB traditionally refers new traders to their preferred broker for a commission. Read more about how introducing brokers operate for Axi in this guide. During the Asian session, the market usually consolidates and moves in a range. But when the European trading session opens, the market traditionally goes out of range and a trend begins.

In the country of your residence you should register an account with RoboMarkets Ltd (read more).

The Asian/European sessions overlap, sometimes creating more volatility, due to increased trading activity during those hours. The figure below shows the uptick in the hourly ranges in various currency pairs at 7 a.m. The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. This FX time zone is very dense and includes a number of major financial markets. London has taken the honors in defining the parameters for the European session to date. Volatility is sometimes elevated when forex trading sessions overlap.

Her expertise is in personal finance and investing, and real estate. Open and close times will also vary during the months of October/November and March/April as some countries shift to/from daylight savings time . Some traders prefer to differentiate sessions by names of the continent, other traders prefer to use the names of the cities. This lesson will help determine when the best times of the day are to trade. Some of the most active market times will occur when two or more Market Centers are open at the same time. The Forex Market Time Converter will clearly indicate when two or more markets are open by displaying multiple green „Open” indicators in the Status column.

There are millions of transactions from other exchangesother countries, such as Hong Kong, Singapore, and Sydney. If we talk about statistics, since the Japanese yen is the third most traded currency, it accounts for 16.5% of all operations on the Forex market. For now, just know that the market never closes due to the needs of international trade, as well as the needs of central banks and global industries to conduct business. When this is taken into account, forex trading timings are presented as 24/5, which indicates that trading takes place all day, every day throughout the week. Liquidity is another term that can be used to refer to this aspect of the market.

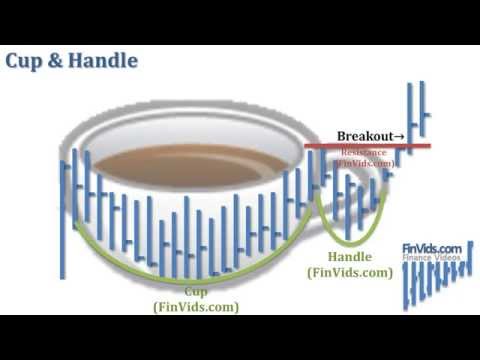

Trading with multiple time frames

Based on the table above, we can see that the average movement of points during this session is 62 pips. In addition, the most volatile currency pairs are those with USD and some pairs with JPY. Thus, whenever news comes from China, it tends to increase market volatility. Moreover, since Australia and Japan rely on Chinese demand, we can expect a significant movement in pairs with AUD and JPY. Because the majority of economic reports are posted online in the morning, at the start of the New York Open, volatility is at its maximum during this time. Liquidity begins to decrease in the afternoon following the end of the European trading session.

- You should be able to easily convert these times in terms of your local time.

- Within these “gaps” in normal trading, currency values can still go up or down, so some traders have strategies for trading gaps to take advantage of this occurrence.

- Forex traders should consider the overlap in market timings, economic news while deciding their trading schedule so that they have enough time to rest and other activities.

- Therefore, the company took additional measures to ensure compliance with its obligations to the clients.

- Because the majority of economic reports are posted online in the morning, at the start of the New York Open, volatility is at its maximum during this time.

Other than the https://forexarticles.net/ends, the only two public holidays when the market is officially closed are Christmas Day and New Year’s Day . The New York session can also be a good option, especially for those looking to trade the release of key economic data from the United States. Aside from the official consensus figure, it is also important to take note of the whisper numbers as well as any revisions to the previous report. Real or Live accounts are different because money used to trade is real money from the owners’ accounts. The trading condition and the benefit that they can bring to the trading process of the traders.

What are the 4 trading sessions time for GMT?

The spreads at these times are lowest for all the pairs involving European, American, and African currencies. However, this may not be the best time to trade Asian and Australian currency pairs like NZD/JPY in Nigeria. At this time the trades are conducted in the European financial centres.

There are four major forex sessions in the world today, London, New York, Sydney, and Tokyo. These are the four key drivers of the forex exchange market that also open at distinct times during the day. By virtue of this, the forex market remains open and tradable 24 hours a day for 5 days a week. The European trading session is one of the most concentrated and most volatile sessions in the forex market. During the European trading hours, market participants conduct most of their deals as the trade volumes are large.

For example, a small branch of the Bank of America in Louisville, Kentucky. However, its downtown Manhattan branch in New York will certainly engage in large-scale foreign exchange deals. Therefore, liquidity and volatility are usually higher when markets are open in these time zones. Even if some brokers allow trading during the weekends, the prices of various currency pairs hardly move on Saturday and Sunday. Because if major financial institutions and professional traders are not placing huge orders that move the market, there is no reason for the solid trends to take place. Almost any Australian forex broker has the ability to access any currency market when open and trade multiple currencies across a trading day.

If this person also has a regular day job, this could lead to considerable exhaustion and, subsequently, mistakes in terms of judgment when trading. A much better alternative for this trader might be trading a different currency pair during the London/New York session overlap, where volatility is still high. Following the weekend, action returns to the Forex market – on Sunday evening for us Europeans – in the form of the Asian trading session. Although not officially, activity from this part of the world is largely generated by the Tokyo capital markets, which is why the session bears its name. In the coming sections, we will examine the three most important sessions and the best times at which to trade them in more detail. But first, let’s look at the open and close times of each of the individual sessions which make up the Forex trading day.

Notably, the majority of sustainable trends in the foreign exchange market occur during the working hours of European banks and stock exchanges. At times like that, European traders monitor the market, try to find the congestion of stop orders, and spot support or resistance levels. Forex trading is not driven by a single exchange but by a global network of currency exchanges and brokers.

Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country’s exchange strengthening. Let’s take a more in-depth look at each of the sessions, as well as those periods when the sessions overlap. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

In copy trading, a trader copies the positions of a professional trader, either automatically or manually. Therefore, you will also have to adjust any price chart timeframes that you are looking at accordingly. It’s important to be aware that DST will affect forex market hours. As such, being mindful of when the clocks go back or forward will aid you in trying to predict the markets. Whilst the majority of East Asia does not observe daylight saving time, heaps of countries do.

Understanding these different forex session times can improve the reliability of a forex trading strategy. While the forex trading hours stay open 24 hours every day, it is important to distinguish the opening hours of the four distinct sessions. Usually, the market period opening times depend on the opening time of the stock exchange market of that particular country or region. The American, European, as well as African markets, are active during this time.

When you just broke up with your significant other because you chose https://forex-world.net/ forex over him or her. Fridays – liquidity dies down during the latter part of the U.S. session. Sydney, Australia (open 5 p.m. to 2 a.m.) is where the trading day officially begins. She has 20+ years of experience covering personal finance, wealth management, and business news. Experience our FOREX.com trading platform for 90 days, risk-free. Keep this in mind if you ever plan to trade during that time period.

.jpeg)

.jpeg)

.jpeg)